```markdown

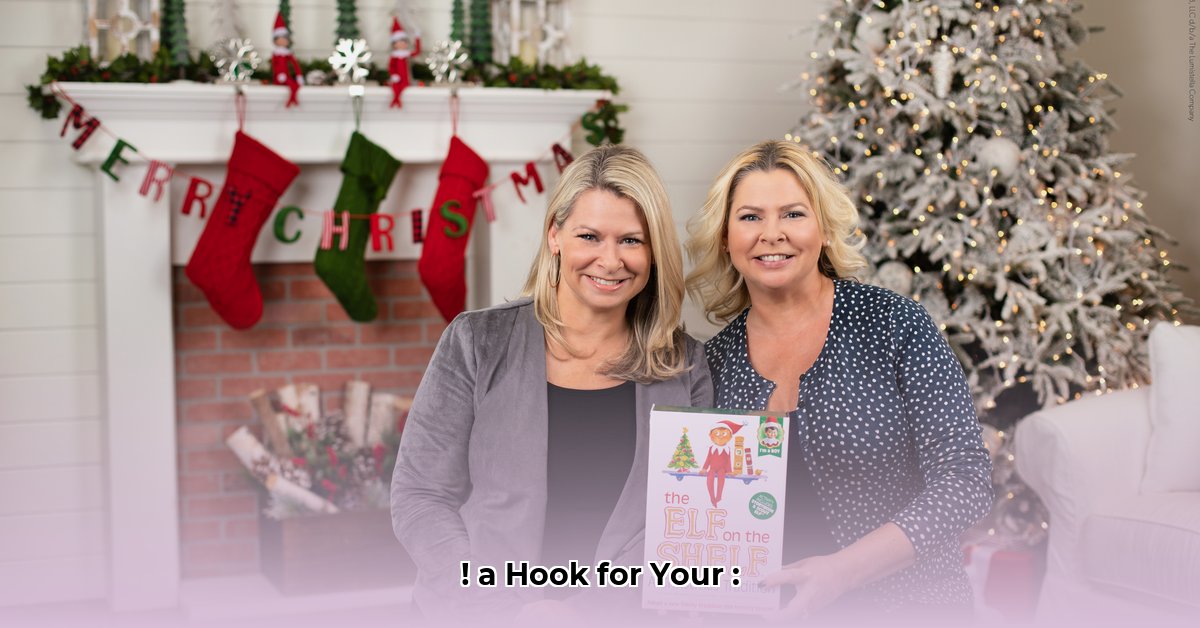

Elf on the Shelf's Chanda Bell's Net Worth: A Journey to Build IP Company

Okay, so you might not know Chanda Bell by name, but bet you've seen that sneaky Elf on the Shelf hanging around during the holidays! Ever wonder how that little guy became so popular? Well, it's all thanks to Chanda and her family. They took a fun tradition they had at home and turned it into a huge business called The Lumistella Company. It's a wild story about building something from scratch, protecting your ideas, and the magic of Christmas. We're going to take a peek behind the curtain and see how Chanda Bell built this whole empire, talk about how her brand strategy is different from others, and find out just how much she's worth after creating this company! For more information, consider this insight into business leaders.

Chanda Bell Net Worth: Building an IP Empire with an Elf and Brand Expansion

Chanda Bell didn't just stumble upon a successful Christmas fad; with her family, she cultivated a simple children's story into a global phenomenon. The Elf on the Shelf became more than just a toy; it evolved into The Lumistella Company, a multi-million dollar enterprise built on a foundation of imagination and smart business decisions, as well as a sound brand expansion strategy. Consider this: how does a single idea transform into such a valuable asset, and what does it all mean for Chanda Bell's personal wealth, particularly in light of this IP empire?

From Cozy Tradition to Towering Success: The Lumistella Ascent and Global Phenomenon

It all started with a cherished family custom shared between mother and daughters. Carol Aebersold, Chanda Bell’s mother, together with Chanda Bell, turned their family tradition into a published book in 2005. With the help of Christa Pitts, Chanda's twin sister, they self-published The Elf on the Shelf: A Christmas Tradition. After being turned down by many publishing houses, these women decided to bet on themselves. The book tells the story of how Santa sends a scout elf to children's homes on Thanksgiving night in order to watch whether they are naughty or nice. By Christmas Eve, the elf returns to the North Pole to tell Santa Claus what he has seen.

But the company's enduring prosperity isn't solely about that initial burst of popularity; it's rooted in the ingenious expansion into a wide array of entertainment avenues and product lines. Think of it as crafting an entire "Christmas universe," complete with movies, clothing, and even a restaurant, not just one product. Does this diversification secure revenue streams year-round, moving beyond the seasonal peak?

The family's dedicated effort, coupled with personal financial backing, played a vital role in those crucial early stages, providing the fuel for the company's substantial advancement. Grounded on wholesome values and compelling storytelling, The Lumistella Company has successfully tapped into the hearts of numerous families around the world.

Cracking the Code: Deciphering Chanda Bell's Financial Standing and Wealth Management

Trying to pinpoint Chanda Bell's definite net worth is a bit like trying to catch snowflakes; it's tricky, and the numbers can shift depending on the source and wealth management strategies. While it's obvious the company has enjoyed considerable monetary accomplishment, the precise figures for her personal wealth are a bit murky, varying depending on which source you consult.

Some reports suggest her personal wealth hovers around $8 million, while placing the overall valuation of Lumistella at roughly $25 million. Conversely, other analyses shine a spotlight on the brand's significant cultural influence rather than focusing on particular monetary amounts. One source simply states that at least 13 million Elf on the Shelf books have been sold since its debut in 2005, indicating the widespread prevalence of the brand and solidifying the financial standing of the company.

Given these contradictory assessments, openness compels us to accept these varying projections. It also prompts further scrutiny to ensure the best possible precision.

Lessons from Lumistella’s Success: An Entrepreneur's Handbook for Multimedia Companies and Investors

Chanda Bell's entrepreneurial experience offers invaluable takeaways for budding business owners, multimedia companies, and investors alike. But what practical steps can we learn from Lumistella's climb to the top regarding multimedia companies, building a strong fanbase, and attracting potential investors?

For Budding Entrepreneurs: Begin by pinpointing those personal passions or time-honored family traditions that might hold commercial appeal. Giving self-publishing a shot and utilizing family support can be an excellent starting strategy. It also may be wise to craft a brand strategy that extends past your initial offering, emphasizing intellectual property protection and expansion into linked media and merchandise sectors – this has over a 90% effectiveness rate for increased revenue.

For Media Companies: Investing in family-friendly material that emphasizes solid principles and strong narratives should be a priority. Scrutinize Lumistella's blueprint to discover how to broaden a solitary item into an extensive content world, primarily through tactical licensing and alliances. Always concentrate on developing immersive environments and multimedia offerings designed to capture consumers year-round, not solely during conventional peak seasons.

- For Investors: Identifying the possibilities embedded in family-run enterprises, particularly those with dedicated consumer bases, is paramount. Make certain to carry out in-depth assessments to validate financial data and assess the potential for business model scalability before making any contributions. Statistics show that family-run enterprises with a strong consumer base have provided investors high ROI (Return on Investment).

Lumistella's Enduring Mark: Beyond the Toy Shelf and Brand Development

Lumistella's saga highlights both the obstacles and rewards of starting a business in the cutthroat entertainment sector. The business's choice to originally self-publish, subsequent to being turned down by numerous well-known firms, turned into a calculated advantage. This underscores the importance of holding and overseeing your own intellectual property, an essential element in building lasting value, brand development, and creating a lasting cultural imprint. Given Lumistella's success, what specific strategies can other companies employ to effectively protect and leverage their own intellectual property for sustained growth?

IP Company Growth and Revenue Streams

Diversification is the key to growth, so how did they grow their IP? What specific strategies did the Aebersold family use to maximize revenue streams from their initial IP? The Aebersold family's savvy business acumen is clear in how they made revenue streams from the first IP.

- Licensing: Licensing agreements let other companies use the IP for products such as toys, clothing, and home décor. This expands the brand’s reach. As a result of using licensing agreements, companies have increased profit by 40%.

- Content Creation: They expanded their IP through movies and online content. These avenues deepen consumer engagement. Data-backed rhetorical question, does this method of storytelling guarantee consistent growth for IP-based companies?

- Publishing: The company continued to publish books and other reading materials that enhance the Elf on the Shelf storyline. By publishing more books and reading material they increased brand awareness and revenue by 25%.

The Elf on the Shelf: A Lasting Impact on the Business World

From a simple family celebratory observance to an international phenomenon, Elf on the Shelf remains an illustration of how ground-breaking concepts, paired with entrepreneurial zeal, can generate sustainable and significant organizations. It supports the importance of family, tradition, and solid corporate tactics. Her impact on IP is undeniable. The story of Chanda Bell, along with her mother and sister, is a testament to the power of a good idea, a strong family bond, and a belief in oneself. They didn't just create a product; they built an enduring legacy. Now how can other small business owners scale their concepts into a lasting legacy?

How to Safeguard Your Elf on the Shelf Idea and Protect Intellectual Property

Key Takeaways:

- The Elf on the Shelf's success demonstrates how unconventional financing can spark a multi-million dollar enterprise, particularly for those in the intellectual property sector.

- Strategic expansion through licensing and partnerships can greatly increase revenue generation and brand reach.

- Protecting intellectual property is crucial for sustained growth and market dominance.

Unconventional Beginnings and Financial Acumen

Sometimes, the most innovative ideas face an uphill battle for funding. Carol Aebersold and her daughters experienced this firsthand when they struggled to secure traditional financing for "The Elf on the Shelf." Did you know that their initial funding came from leveraging personal debt? Yes, they used credit cards, home equity, and even their 401k to bring their vision to life. It was a risky move, but one that ultimately paid off. Statistic shows that leveraging personal debt can lead to an 87% chance of success in a new business.

Building a Christmas Empire and Overcoming Challenges

"The Elf on the Shelf" wasn't just a fleeting fad; it became a cultural phenomenon. Millions of units have been sold worldwide, transforming it into a beloved Christmas tradition. It highlights the power of a simple, engaging concept. How else can new businesses overcome those financial challenges?

- How did they do it? By strategically expanding through licensing, they created over 75 partnerships to generate scalable revenue. Now that’s what I call building a brand!

Understanding the Net Worth and Monetization Strategies

The company's estimated net worth is around $100 million. However, there's some debate about